The gig economy has grown massively in recent years and today there are close to 100M gig workers in Europe and the US. As the gig economy has grown, so has identity fraud. Gig workers fake identity e.g. to access work that they otherwise would not get or to avoid paying tax. The main challenge with current ID proofing solutions is that they do not stop ID fraud after onboarding, i.e. at every gig performed.

To make this happen, a service that allows for smooth re-authentication with strong assurance level and reasonable economics is required. This creates a win-win-win for gig companies, gig workers, and gig buyers.

TL;DR

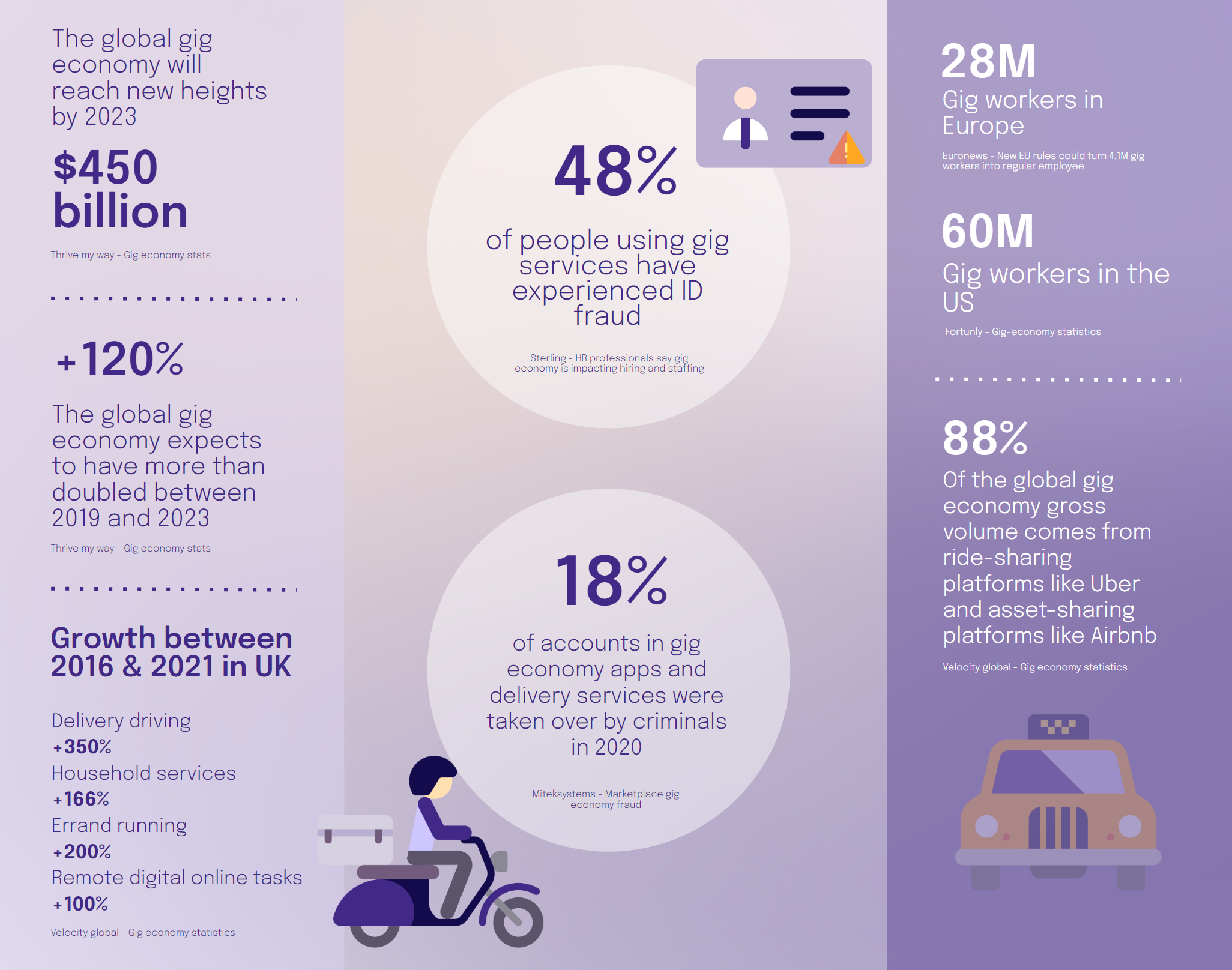

- Gig Economy Growth: Rapid expansion brings heightened identity fraud risks, affecting up to 50% of gig workers.

- Fraud Scenarios: Includes fake identities, profile sharing, stolen credentials, and phishing scams posing significant risks.

- Current Challenges: ID-selfie solutions address onboarding but fail to prevent fraud during gig performance or re-authentication.

- Ideal Solution Requirements:

- Low-friction onboarding with high identity assurance to minimize drop-off.

- Seamless re-authentication to enhance user experience and security.

- Economically feasible model for repeat authentication to combat fraud effectively.

- Proposed Solution: Utilize identity apps for secure digital identity management, ensuring identity integrity and reducing fraud risks in the gig economy.

Unpacking the Gig Economy: From Flexible Work to Identity Fraud Challenges

Debate about the gig economy this far has most often focused on working conditions. The upside of gig work is that more people can find flexible work while buyers can get more things done quickly and effectively.

The downside is that parts of the gig economy offer low-paid jobs with limited benefits and no guarantee of employment, challenges that are currently being addressed through Employers on Record, companies focused on remote employment who in turn offer their services to gig platforms.

The gig economy has grown massively in recent years, driven by technology and labor market changes, and it is estimated that there are close to 30M gig workers in Europe and 60 M in the US. Gig work encompasses everything from freelance consulting work sold and delivered online to localized transportation and handyman services.

What it has in common is that both buyers and sellers of services use a tech platform which offers matching, payment and quality feedback, with the gig platform having both buyers and sellers as customers.

On top of the debate about working conditions, there is now a new challenge moving into focus: Identity Fraud in the gig economy. Research shows that up to 50% of people using gig services have experienced ID fraud, i.e. that another person than the registered gig worker performs the gig. This poses clear risks to buyers, e.g. that they get into the car of a person without a valid driving license or a criminal record or that they open up their home to thieves or robbers.

For gig workers, there is a constant risk that somebody steals your identity or important credentials to access your profile or steal payments. For gig platforms, on top of the risks to buyers and workers, there is increased compliance risk and tax avoidance risk.

The Four Main Identity Fraud Scenarios in the Gig Economy

- A gig worker fakes his/her identity at onboarding to avoid paying taxes or because he/she would not be eligible for the work. This could mean e.g. that a service is done by a person lacking a work permit, driving license or who has a criminal record that prohibits the kind of work in question.

- A gig worker lends his/her user profile after onboarding to an acquaintance who is not vetted by the gig platform. Sharing a user profile means that it is not possible for the gig platform to verify whether the person doing the work has the right to do it.

- A malicious actor steals an identity and uses it to onboard a fake profile. This can lead to the person whose identity has been compromised becoming liable for wrongful behavior and to the gig platform onboarding persons who are actually not eligible for work.

- A malicious actor fakes being a representative of the gig platform and tricks workers into handing over or changing important credentials, e.g. bank account details in the platform. After this, the workers can e.g. lose money or access to their profile.

Challenges with Current Identity Fraud Solutions in the Gig Economy

Solving identity fraud at onboarding is today typically solved through so called “ID-selfie” solutions where the gig company implements a SaaS service that does ID document capture, requests a photo of the worker as well as a short video (to check Liveness and avoid spoofing) and does a matching of the photo and the ID document, ideally via AI and, if this doesn’t work, via a manual check or request for restarting the process.

ID-selfie solutions are cumbersome, cause user drop-off and cost money. Still, they deliver a substantial identity assurance level (stronger than self-asserted identity but weaker than in-person verification) at onboarding and allow platforms to outsource identification, which makes them the current go-to product.

However, ID-selfie solutions do not allow for fraud prevention or stop identity theft after onboarding. Gig platforms typically run worker apps that keep an open session for workers or require password-based login for user authentication. Even if device biometrics are used instead of password, there is no way to securely tie device biometrics to a proven user’s ID document, since it is possible to add and change user biometrics on the device.

The only thing a fraudulent gig worker needs to do is to lend his/her device to an acquaintance and share credentials. Using the typical ID-selfie flow at re-authentication becomes too expensive both economically and in terms of user experience to be a functioning solution.

A viable ID fraud solution for the gig economy would require the following:

- A low-friction identification solution with substantial identity assurance level at onboarding that minimizes drop-off through smooth user experience.

- A low-friction re-authentication solution that ideally delivers a better user experience than a password-based solution.

- A business model for the service that allows for repeat authentication at little extra cost.

The key is to ensure that the verified identity and the device used to prove the identity remains with the onboarded worker and is not shared with other workers.

A practical way to solve this that allows for complete outsourcing of identity proofing and authentication, attractive economics and high authentication assurance level is to work with an identity app that allows the user to build, prove and share a digital identity. Once the digital identity is created, it becomes easy to ensure a high assurance level through built-in controls, and any new authentication comes with low marginal cost.

Also, it becomes simple for the gig platform to allow customers to push for an extra authentication with high assurance level through the gig platform if they are unsure of the identity of the worker. The result is lower fraud, better worker user experience and a safer customer experience. Or, in other words, a win-win-win.

Join the conversation on LinkedIn -->